Understanding of Bull Call Spread Options Trading Strategy

Published: September 25th, 2021

Bull Call Spread Options Trading Strategy with Live Example of Nifty

What is Bull Call Spread?

A Bull Call Spread is an Options Trading Strategy which generally involves two legs ATM (At the Money) & OTM (Out of the Money) simultaneous buying of ATM (At the Money) call Option and simultaneous selling of OTM (Out of the Money) call option (CE) for the underlying asset with the same expiration date.

Here traditional bull call spread involves combination of ATM & OTM call option however the bull call spread can be created by using different strike prices as well.

Key Points to Remember

- Buy 1 ATM Call Option (CE) & Sell 1 OTM Call Option (CE).

- All Strike Prices belongs to same expiration date / same series.

- Remember to buy the same number of lots / legs.

- In a Bull Call Spread a Trader is betting on that underlying have limited increase in the price.

- The Bull Call Spread limits the losses at the same time it also limits the gains.

In Bull Call Spread Strategy the premium received by selling the call option partially offsets the premium paid by the trader while buying the call option. In this strategy the traders pays the premium of net difference and which is the cost of this strategy.

So now it’s time to understand the Bull Call Spread Strategy with the example

Date: – 25.09.2021

Nifty Spot Price: – 17853 (24.09.2021 close price)

So your outlook is moderately bullish and you are expecting market to go higher but expiry around the corner could limit the upside so you are planning for creating a Bull Call Spread

ATM – 17850 CE 30 Sep 2021 – Rs. 117.20

OTM – 18050 CE 30 Sep 2021 – Rs. 45.00

So Bull Call Spread Set is as follows

- You are buying 17850 CE by paying Rs. 117.20 & you are paying a premium of Rs. 117.20 X 50

- And Sell 18050 CE at Rs. 45.00, by selling CE here you are collecting a premium of Rs. 45 X50.

- So the Net Difference here is 117.20 – 45 = 72.2 so this 72.2 is you net debit here 72.2 X 50 is your net loss in this strategy.

Max Loss is the net debit paid and hence the bull call spread is also called as debit bull spread.

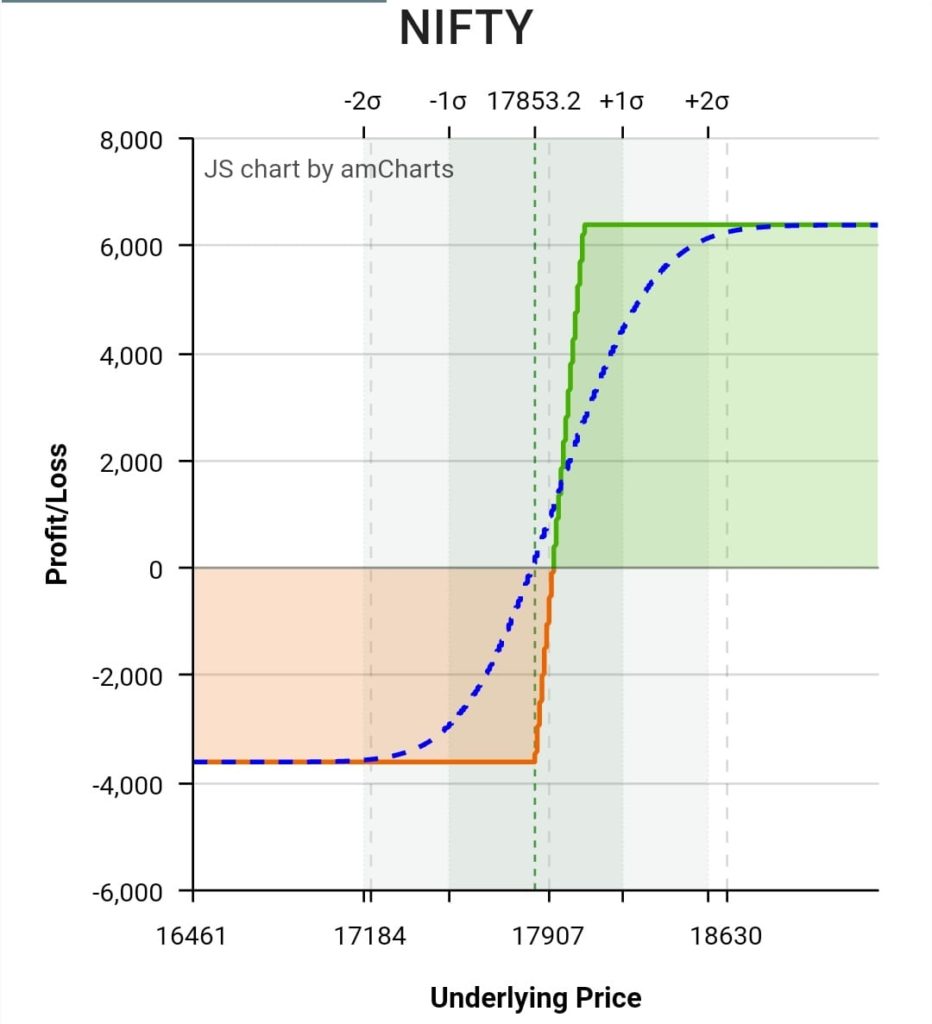

So let’s have a look on the below payoff chart of the above Bull Call Spread.

Open Free Trading and Demat Account Click Here

- Nifty CE 17850 – Buy 117.2 Expiry 30.09.2021

- Nifty CE 18050 – Sell 45 Expiry 30.09.2021

- Risk Reward – 1 : 1.77

The Bull call Spread Strategy Makes loss if Nifty Expires Below 17850, however the loss is restricted to 72.2 X 50 i.e. Max Loss – 3610 (Net Debit).

The Bull Call Strategy breakeven at 17850 + 72.2 = 17923

Max Profit is – 200 – 72.2 = 127.8 X 50 = 6390

The above strategy is very popular strategy and most of the traders are using the same as it’s simple to understand and easy to implement moreover the profit and loss are already limited to the maximum. So the trader is well aware about the max profit and max loss. The nifty in the above example may expire in between both the strike prices and according the profit or loss will change however it’s limited.

In the present example of nifty it’s likely that nifty might consolidate or might make a move towards 18000 levels and the risk reward in this strategy is also favorable for the traders so it’s linked with the live example of nifty.

Bull Call Spared you can implement in any of the instruments such as nifty, banknifty, currency, stock options, commodities etc.

I hope the strategy is well clarified for understanding and it’s also simple and you don’t need to look for options Greeks and so on.

Just predict the move and accordingly deploy the strategy, in earlier we have also explained few options trading strategies which can be referred to learn and practice.

Kindly share your feedback on the options trading strategies explained and also update what type of contents you are expecting on the website, do share the contents blogs if you like it with your near and dear ones

Disclaimer : – The Strategy is only for Educational Purpose and not a recommendations to follow.