Stock Market Outlook – Nifty and Bank Nifty Prediction Analysis for Upcoming Week Starting from 31st May 2021, Reliance Stock Analysis, F&O Traders – Trade Set Up in Grasim Industries, Break Out Stocks – V Guard

Published: May 30th, 2021

Stock Market Outlook – Stock Market Analysis and Prediction for Upcoming Week Starting w.e.f 31st May 2021

In this section we will discuss about the stock market movement and based on the technical charts and options data we will try to predict the stock market direction / range for next week / upcoming week. Basically we will study the nifty and bank nifty charts in this section and after analysis we will be able to conclude the market direction, important support and resistance levels which can ultimately help in traders and investors for getting the picture on the market and help them taking in a trading and investment decisions.

Nifty Prediction for Next Week, Nifty Overview, Nifty Options Chain Analysis (31st May 2021 to 4th June 2021)

Last week Nifty hits all time high of 15469 and was sustained and closed at 15435 nearby the previous all time high of 15431. Now most of the traders and investors are scared and thinking that market will crash from here, market will significantly fall from here. We will analyze here and will try to find out what charts and Options data says. So lets get started with the charts analysis.

https://in.tradingview.com/chart/tWswsFjd/?offer_id=10&aff_id=26808

Above weekly charts of the Nifty giving you the longer terms picture and you can see the flag and pole breakout in nifty weekly charts and from the weekly charts we can draw the longer term targets for Nifty which comes arroung 16750 to 17000.

Now let us have a look at Nifty Daily charts which clearly broke out of the previous all time high range and closed at near by previous all time high. The difference between previous all time high and here is that market after hitting all time high sustained and showing strength in the present move. So in coming days we might see 14700-14800 levels in a very short time. So the traders can follow the buy on dip strategy in Nifty for getting higher levels. You can also refer the nifty video for more understanding.

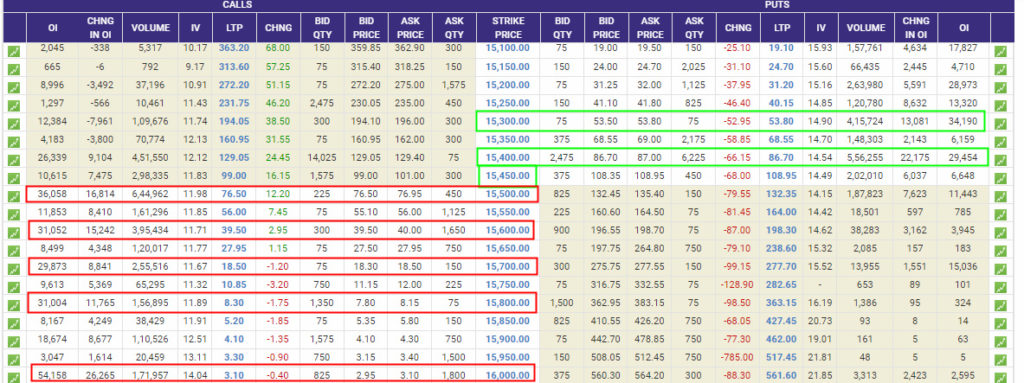

Nifty Options Chain Analysis

From the Options Chain Data refer the options chain below in the table it looks like 15400 & 15300 are the key support areas, going forward we may not see the nifty below 15300 in next week.

Key Support – 15400 & 15300

However on the resistance we can see the resistance at 15500 – 15600-15700 & 15800 levels. Break above one level we can expect the next levels.

Key Resistance – 15500-15700

Bank Nifty Analysis , Banknifty Prediction for Next Week (31st May 21 to 4th June 2021).

Banknifty sustained above the previous breakout levels and now we are above key levels with a pattern break out and we might see the strong rally in Bank nIfty in the coming week. Lets have a look at Bank Nifty Charts as below

Banknifty present close is at 35141 and now the key area of support is 34800 and below that 34251, which is the key breakout point so in coming days we might not come below 34251, however on the upside we might see the 36000 plus levels in the next week and probability of Bank Nifty hitting all time high is also very high so one can see banknifty heading towards much higher levels. The detailed analysis and explanation video also uploaded.

Click Here To Open Trading and Demat Account with Upstox Best Offer for You

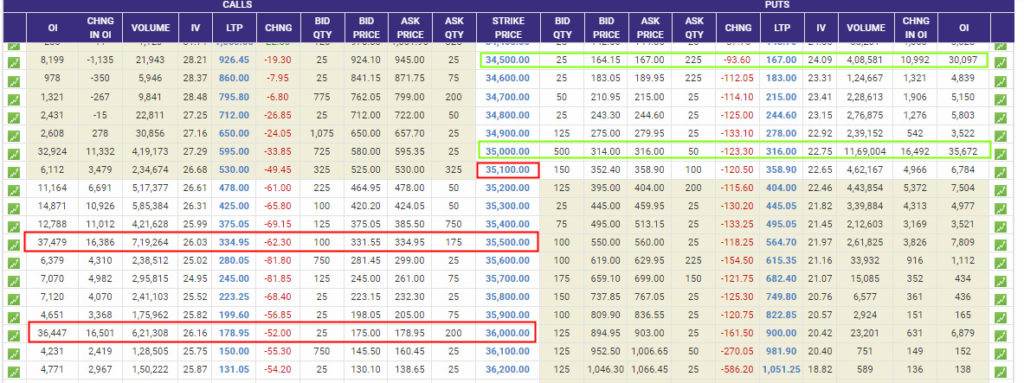

Bank Nifty Option Chain Analysis

Key Support – 35000 (We might not see 35000 below in next week levels) so 35000 is the key point as per options chain. Slide Below 34500 is the key area.

Key Resistance at – 35500 & 36000 and we can expect bank nifty to move towards higher levels.

So from the Option Chain Analysis we have to keep in mind the levels as derived from the derivative data.

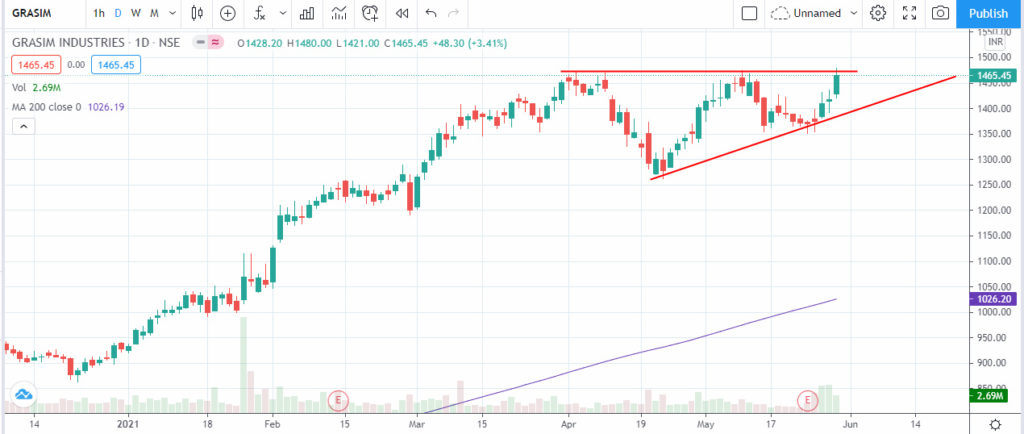

F&O Trade Set Up – Grasim Industries Ltd, the trade set up is for Futures and Options traders off course cash traders also can take the positions and the levels are updated below at cash levels. This trade set up offers good favorable trade set up with a Risk – Rewards of 1:4 Buy above 1480 with SL at 1419 Target at 1724 (61 SL & 244 Points Target)

Options Trades can think of Buying 1500 Call Options around 38 with SL of 25 current month expiry and keep trailing and if some one want to play secured can short 1600 Call Option so that the net premium can be collected. Even 1600 CE is trading around 14 so net premium will come only 24.

V Guard

Have a look at below chart of V Guard showing strength on weekly charts and given breakout above 250 levels which was crucial and was sustained above 250 levels. Now V Guard is a great opportunity for traders and investors which can offers good levels in upcoming weeks. The levels expected in V Guard are around 370-380.

Reliance Industries

Reliance Industries offers a very good opportunity for traders and investors and from the below charts we may see Reliance heading towards all time high levels and may hit 2700 kind of levels in the upcoming weeks.

Disclaimer : – The contents posted here are only for Educational purpose and not a buying or selling recommendations, do consult your financial advisor before taking any decision.