Market Outlook, Stock Market Outlook, Share Market Outlook – SSV Education, Nifty Prediction for Monday, Bank Nifty Prediction, Nifty Analysis, Bank Nifty Analysis

Published: June 13th, 2021

Hello and Welcome Everyone in this new episode of stock market outlook for Monday and upcoming week. In this section we will discuss in details about the nifty, bank nifty and analyze it on charts and also options chain data and we will also provide the key levels for nifty and bank nifty to be kept on watch for. So please go through the complete update on this week stock market outlook and also suggestion if any changes and share your feedback with us,

Stock Market Outlook – Stock Market Analysis and Prediction for Upcoming Week Starting w.e.f 14th June 2021

In this section we will discuss about the stock market movement and based on the technical charts and options data we will try to predict the stock market direction / range for next week / upcoming week. Basically we will study the nifty and bank nifty charts in this section and after analysis we will be able to conclude the market direction, important support and resistance levels which can ultimately help in traders and investors for getting the picture on the market and help them taking in a trading and investment decisions.

Nifty Prediction for Next Week, Nifty Overview, Nifty Options Chain Analysis (14th June 2021 to 18th June 2021)

Last week Nifty again hits fresh all time high of 15835 and made a low of 15566 during the week. Nifty Closed the week at 15800 levels with formation of spinning top or doji pattern in the last trading session of the week.

https://in.tradingview.com/chart/tWswsFjd/?offer_id=10&aff_id=26808

Now look at the above nifty daily chart which is showing the early sign of divergence not yet confirmed. By looking at the chart we can say that nifty definitely has lost some movementum so in this situation it is likely that nifty might consolidate here between 15500 to 15800 range. In case nifty breaks above 15840 and sustains we can see the continuation of bullish movement and in such condition nifty may cross 16000 levels.

The other prospective on nifty daily charts you can see the small flag and pole formation and break above the line we can say that yes it is a valid flag and pole formation.

Also as updated in the previous weeks about the nifty flag and pole break out on weekly charts and shown excellent move after break out and the target are appearing in the range of 16750 – 17000, before inchining up further market might take some rest and is likely to consolidate.

Nifty Options Chain Analysis

Now let’s have a look at the below options chain data, nifty spot at 15800 and highest open interest built up seen on put side at 15700 followed by 15000 so 15700 looks strong support and 16000 is highest open interest built up. so from the options chain dada we can say that 15700 is support for next week and 16000 is resistance.

Bank Nifty Analysis , Banknifty Prediction for Next Week (14th June 2021 to 18th June 2021).

Bank Nifty is still under performing and way below it’s all time about 6 & 1/5 %. Last week bank nifty movement was very narrow and the high of the week was 35545 where as low at 34641.

Now Let’s have a look at the above chart of bank nifty which is forming a shape of flag and pole and sustained break above the marked line of resistance (35600), we can expect bank nifty movement towards all time and the target can be established form this flag and pole breakout, whereas the bank nifty break below 34500 can drag nifty down and bank nifty can then fall further.

Click Here To Open Trading and Demat Account with Upstox Best Offer for You

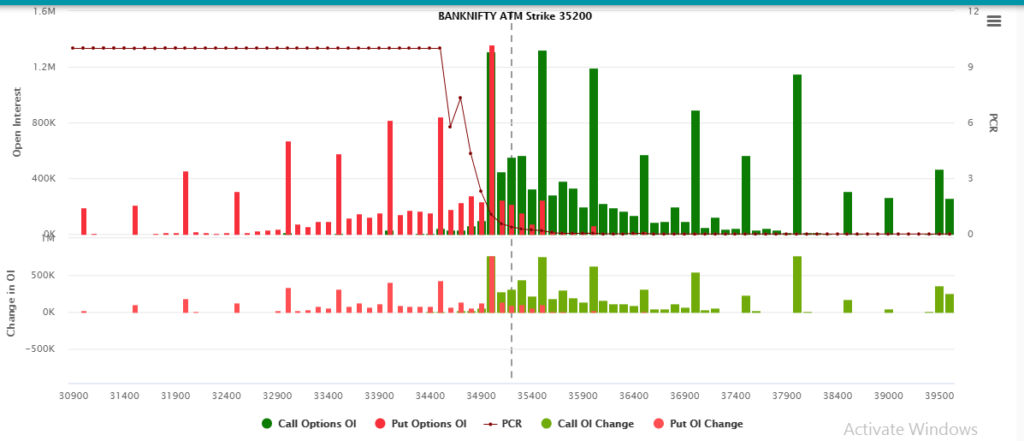

Bank Nifty Option Chain Analysis

See now it is very interesting to see bank nifty options chain and we can see the open interest at 35000 Put is highest & the change in open interest in bank nifty 35000 is highest which is a indication that bank nifty will sustain above 35000 & the open interest at 35500 is significant and break above this we can see the big upside.

So overall bank nifty is giving bullish interpretation.

Hemisphere Properties

Update on last week chart of Hemisphere Properties and we have seen the stock has come out of the box range and now above 168 levels we can see 201 levels and we will keep updating on this stock. We can see the multibagger potential in this stock.

Disclaimer : – The contents posted here are only for Educational purpose and not a buying or selling recommendations, do consult your financial advisor before taking any decision.