SBI Cards and Payment Services Limited (SBI Card)

Published: February 27th, 2020

SBI Cards and Payment Services Limited (SBI Card) IPO Review – Why I should subscribe for this IPO?

Brief Overview of the Company

SBI Card was launched in October 1998 by the State Bank of India and GE Capital. Incorporated as SBI Cards and Payment Services Private Limited (SBICPSL), SBI Card is headquartered in Gurgaon, Haryana.

In December 2017, State Bank of India and The Carlyle Group acquired GE Capital`s stake in the Company. SBI holds 74% while Carlyle holds 26% in SBI Card.

The legal name of SBI Card was changed on 20 August ’19, from SBI Cards and Payment Services Private Limited to SBI Cards and Payment Services Limited, on account of its conversion from a “Private Limited” company to a “Public Limited” company

The aim of SBI Card is to offer Indian consumers access to a wide range of world-class, value-added payment products and services. SBI Card endeavor is to simplify the lives of customers, employees and other important stakeholders.

First Biggest IPO of Year 2020 SBI Cards & Payment Services Ltd Issue Opens on 2nd March 2020 & closes on 5th March 2020.

SBI Cards IPO is Unique Opportunity Investors to apply for this IPO as this is the only company operates credit cards business separately and is going to be listed on NSE and BSE first company in the sector.

SBI Card is the 2nd largest company which offers the credit card business after HDFC Bank being the No. 1 company in this business.

Top 4 Companies offers Cards Business and cover in total 75-80% of the business are 1. HDFC Bank 2. SBI Card 3. Axis Bank and 4. ICICI Bank

Issue Details

SBI Card is coming with a median combo of fresh equity issue as well as offer for sell

- Issue Price Rs. 750-755 /-

- Issue Opens 02.03.2020

- Issue Closes 05.03.2020

- Minimum Bid (No. of Shares) 19

- Listing on BSE, NSE

- Company Website www.sbicard.com

- Minimum Investment Amount in Rs. 14250/-

- Issue Size (Rs. Cr.) 10286.20

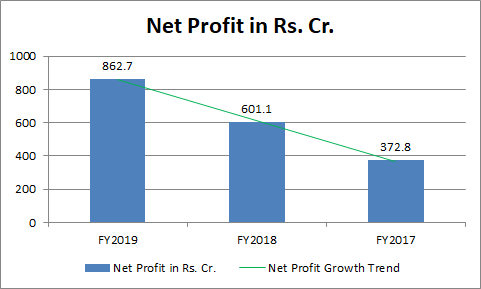

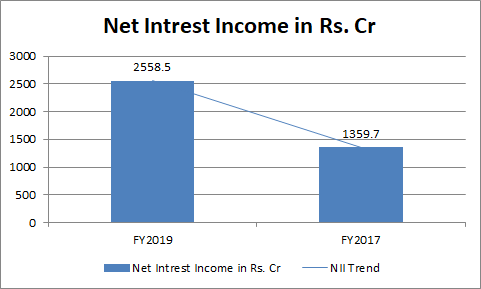

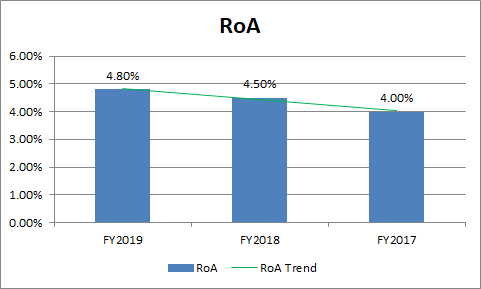

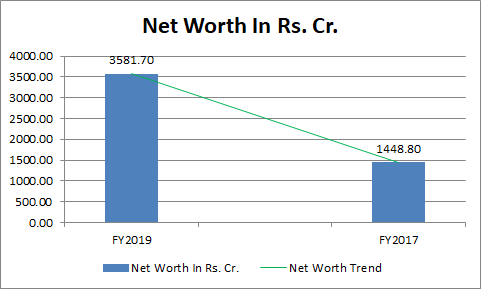

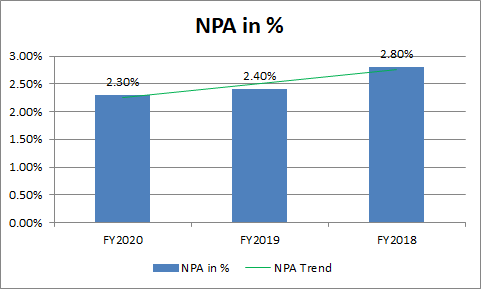

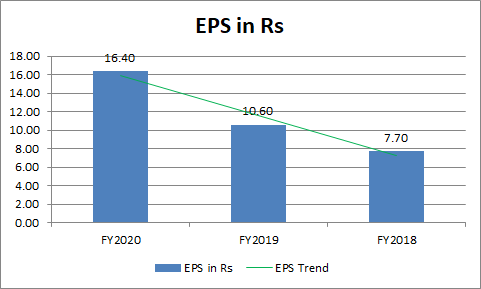

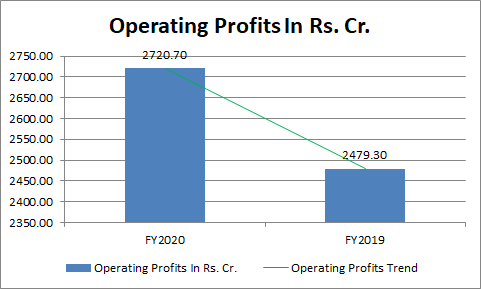

Key Financials of the Company

Why You Should Go for this IPO

- Above financial trends shows good and consistent growth in business

- Card Penetration is hardly 4-5 % at present wrt GDP (card penetration was 2% in 2017, 3% in 2018 & about 4% in 2019 so you can see the growth and opportunities for this business.

- SBI Cards ranked 2nd no company in terms of credit card base and credit card spends

- Currently credit card base stands at 18% & credit cards spends stands at 17.9% in overhaul business.

- Presence in Tier – 2 & Tier – 3 cities and continuous expansion.

- Transparency in business

- Promoter is largest public sector bank and hence more trust on the business.

- Strong Corporate governance and brand name

- Business expansion by means of partnership with departmental stores, apparel, travel , entertainment, IRCTC, Ola etc.

- Fastest Growing Business

Important disclaimer

Please make a note that nifty and banknifty index futures weekly trend analysis / levels posted here is based on our studies and the knowledge we have on the markets. All the contents posted here are for educational purpose only and it is not a buy or sell recommendations.

To join our telegram channel follow below link

https://t.me/onlycrudeblaster https://t.me/joinchat/AAAAAEO7D0uuz3Evm7oD-Q

or simply type t.me/ssveducation on telegramm to join to our channel

If you like the post don’t forget to share. Any suggestion please update in the comment section.

To join the telegram channel ping on the numbers 9406056301

For queries you can email us on info@ssveducation.com